Giving Appreciated Stock

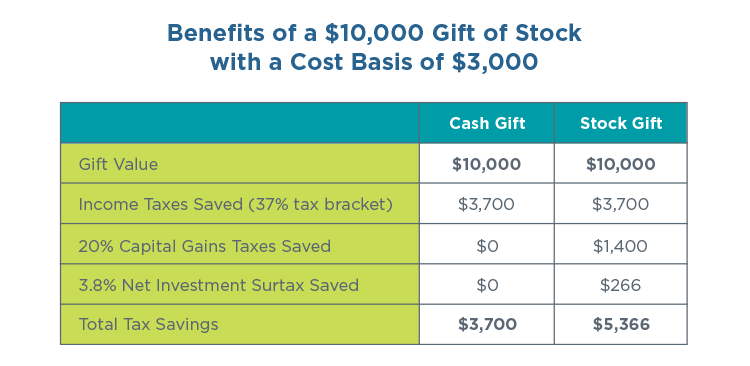

Giving stock is simple, convenient, and impactful. Giving appreciated stock (held for one year or longer) offers greater tax benefits than donating cash. It is also a smart vehicle for "bunching" multiple years of charitable giving into a Donor Advised Fund.

Some advantages of giving appreciated stock:

- Receive an income tax deduction for the full market value of the stock (up to 30% of your adjusted gross income)

- Avoid paying capital gains taxes

- Generously support the charities that are important to you on your own timetable

To make a stock gift, fill out our online form or contact Elizabeth Peden at (913) 327-8166.

This material is for informational purposes only and should not be construed as legal, tax or financial advice. When considering tax planning strategies, you should always consult with your own legal and tax advisors.